News | Events | Digital PR | Advertising

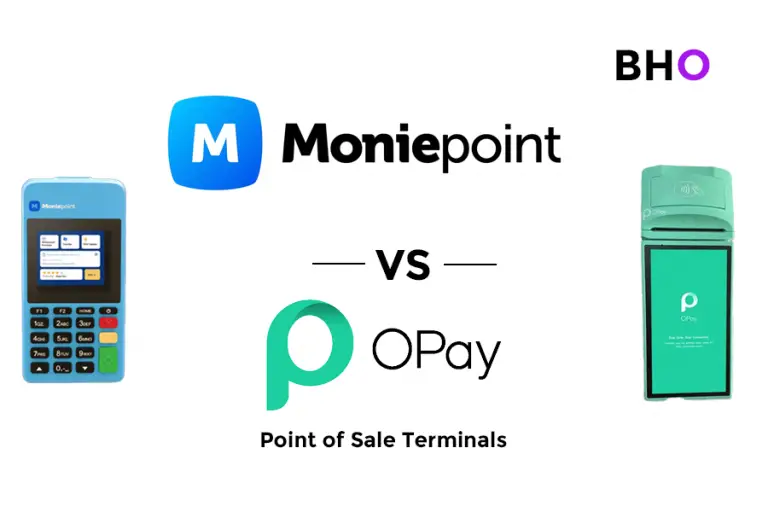

CBN Fines Moniepoint and OPay ₦1 Billion Each Amid Increased Scrutiny of Fintech Sector

As part of its ongoing scrutiny of fintech startups, the Central Bank of Nigeria (CBN) fined two of the country’s leading unicorns, Moniepoint and OPay, ₦1 billion each in the second quarter of 2024, according to sources familiar with the matter, as reported by TechCabal. Several other fintech companies were also penalized, but Moniepoint and OPay faced the largest fines.

The fines stemmed from a routine CBN audit of the fintech sector, which uncovered compliance issues. Sources familiar with the audit process noted that these regulatory checks are standard for banks and financial institutions under CBN oversight.

At least four additional fintech companies were similarly penalized, though details regarding their fines remain undisclosed.

The CBN has increasingly used fines to enforce regulatory compliance. In 2023, Nigerian banks paid a total of ₦678 million in penalties. In October 2024, the CBN and the Securities and Exchange Commission (SEC) imposed a ₦15 billion fine on ten commercial banks, including Zenith and GTBank, for various infractions in the first half of the year.

Previously, Nigeria’s fast-growing fintech sector operated with minimal interference from the CBN. However, the rapid expansion of fintech companies like OPay and Moniepoint—now serving millions of users—has led to heightened scrutiny. OPay, for example, claims around 40 million customers, while Moniepoint processed 5.2 billion transactions in 2023, though it does not disclose specific customer figures.

As these fintech giants have grown, concerns over their regulatory compliance have increased. One major issue is that many fintechs, including OPay and Moniepoint, continue to operate under microfinance bank licenses. These licenses, intended for micro, small, and medium enterprises, have allowed the companies to scale quickly, but there are growing concerns that the licensing framework is insufficient to protect customers, according to one source.

In addition to licensing, the CBN has raised concerns about the fintechs’ adherence to Know Your Customer (KYC) standards. In April 2024, the CBN imposed a two-month ban on customer onboarding for several fintechs, including Kuda Bank and Palmpay, citing KYC non-compliance. This forced fintech companies to revise their onboarding processes and strengthen their compliance measures.

Moniepoint declined to comment on the matter.

OPay, however, denied the claims, stating in a statement to TechCabal, “We categorically refute the claims that OPay Digital Services was fined by the Central Bank of Nigeria to the tune of ₦1 billion for regulatory infractions. These claims are entirely false.”

The Central Bank of Nigeria did not respond to requests for comment.

Explore more

Scientists Research Nigeria’s Okra, Maize, Four Other Crops During NASA’s Space Mission

International astronauts will research six indigenous Nigerian crops and seeds during the...

President Trump Orders Pharmaceutical Companies To Cut Drug Prices Within 60 Days

President Donald Trump on Thursday said he asked major pharmaceutical companies to...

Microsoft To Become The Next $4 Trillion Company

Microsoft (MSFT.O), opens new tab soared past $4 trillion in market valuation...

Importers Slash Petrol Prices Below Dangote Rates Amid Rising Market Competition

Competition has hit Nigeria’s petroleum sector as fuel importers slash petrol prices...

Leave a comment