News | Events | Digital PR | Advertising

Nigeria Saves $20 Billion from Fuel Subsidy Removal and Forex Reform, Says Finance Minister

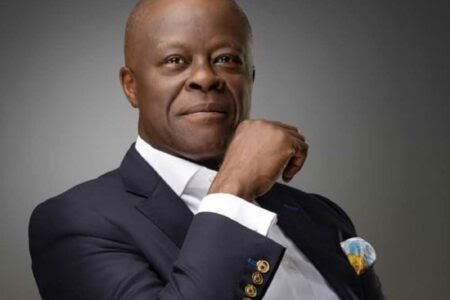

The Minister of Finance and Coordinating Minister of the Economy, Wale Edun, has stated that Nigeria has saved $20 billion by abolishing the petrol subsidy and adopting market-based foreign exchange pricing.

Edun made this announcement during an event in Abuja commemorating the first 100 days in office of Esther Walso-Jack, Head of the Civil Service of the Federation.

President Bola Tinubu had announced the removal of the fuel subsidy in May last year, effective from June. This policy led to a significant rise in petrol prices across the country.

Discussing the impact of the decision, Edun revealed that subsidies had been consuming approximately 5% of the country’s Gross Domestic Product (GDP). He explained, “The two subsidies—on petrol (PMS) and foreign exchange—collectively accounted for 5% of GDP. With a GDP of around $400 billion, that amounts to $20 billion. These funds can now be redirected towards critical sectors like infrastructure, healthcare, social services, and education.”

He further highlighted the broader implications of the reforms, stating, “No one can now exploit cheap funding or foreign exchange from the central bank to enrich themselves without contributing value. Similarly, profiteering from the inefficient petrol subsidy system has ended.”

Fuel subsidies have long been a contentious issue in Nigeria, introduced to make petrol more affordable but often criticized for inefficiency, corruption, and their drain on public finances. While removing the subsidy has eased fiscal pressures and freed up funds, it has also led to increased transportation costs and rising prices for goods and services, contributing to higher inflation.

The policy has faced significant backlash, including protests and criticism, particularly due to its impact on the cost of living for low-income households. In response, the government has proposed measures such as cash transfers and investments in public transportation to mitigate the effects of the subsidy removal.

The debate over the long-term economic benefits of the policy remains ongoing. While the removal has created fiscal space, its success will depend on how effectively the government reinvests the savings to improve the lives of Nigerians.

Explore more

Scientists Research Nigeria’s Okra, Maize, Four Other Crops During NASA’s Space Mission

International astronauts will research six indigenous Nigerian crops and seeds during the...

President Trump Orders Pharmaceutical Companies To Cut Drug Prices Within 60 Days

President Donald Trump on Thursday said he asked major pharmaceutical companies to...

Microsoft To Become The Next $4 Trillion Company

Microsoft (MSFT.O), opens new tab soared past $4 trillion in market valuation...

Importers Slash Petrol Prices Below Dangote Rates Amid Rising Market Competition

Competition has hit Nigeria’s petroleum sector as fuel importers slash petrol prices...

Leave a comment